Beginner-Friendly Trading Strategies PART I: Earnings

In this article we'll discuss a basic options trading strategy that you can try out today with Value Machine. Don't worry, this strategy and many of the of the others in this series are very newbie-friendly and can be executed comfortably with Multi-leg positions.

Earnings Long Strangles Or Straddles

Perhaps the most popular way to trade company earnings announcements using options is to purchase Long Strangle or Long Straddle contract(s) and close them out at the optimal time: Right before the actual earnings event.

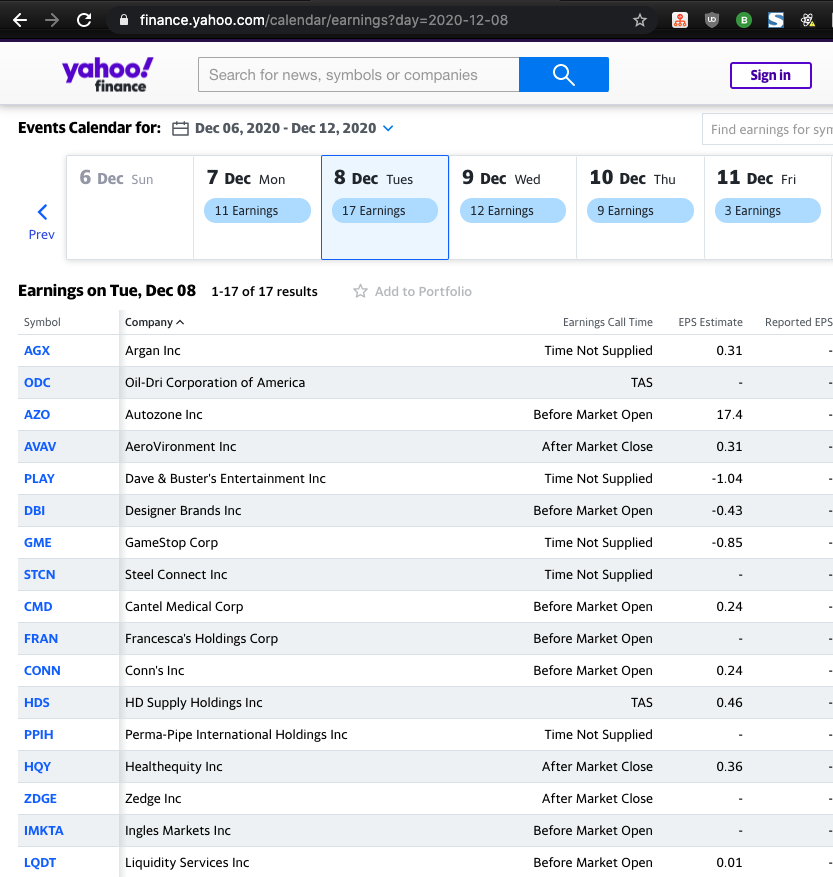

Earnings calendars are crucial to planning out options contract expiration dates!

- Using a trusted earnings calendar, pick a stock whose earnings date is scheduled at minimum four to six weeks out.

As an example, let's go to Yahoo! Finance and use their calendar to find a stock four-to-six weeks out from the date of this blog post. GameStop should be fun...

https://finance.yahoo.com/calendar/earnings?day=2020-12-08

Due to the volatile nature of options premium near earnings we want to buy our positions as early as possible

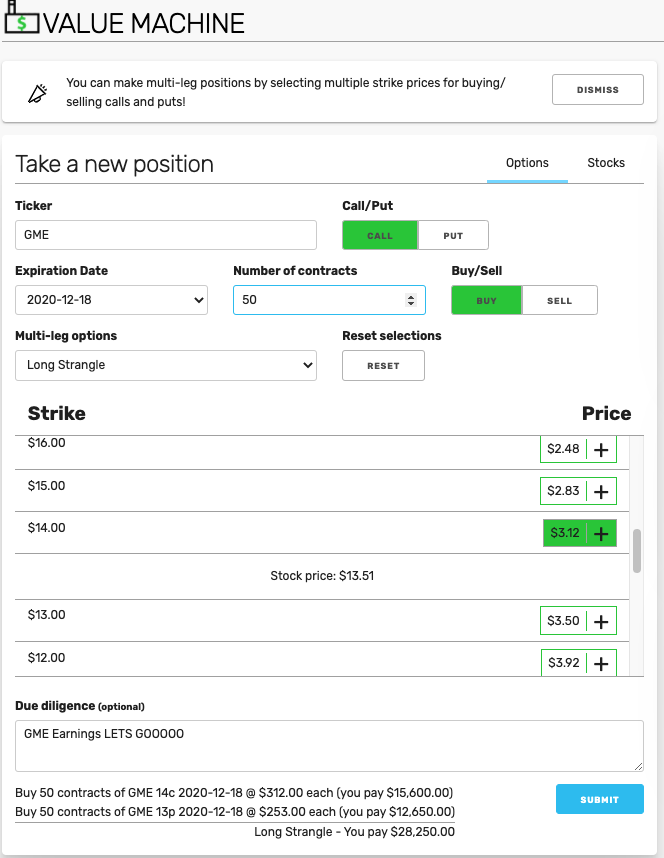

- Now that we have our stock, let's head over to ValueMachine and place an order for a

Long Stranglethat expires the Friday after the earnings date

- Now click the big blue SUBMIT button and you're all set.

When should you take profits?

In general for earnings strangles/straddles remember to close out the position BEFORE THE ANNOUNCEMENT.

How to avoid losses?

For this straddle/strangle strategy we are looking for a huge move either up or down from the price we purchased our contracts at. We lose when the price holds steady or doesn't change much. So if you notice that the stock isn't falling or rising much and it's the week of the earnings, it's best to cut losses.